Market Overview and Projections

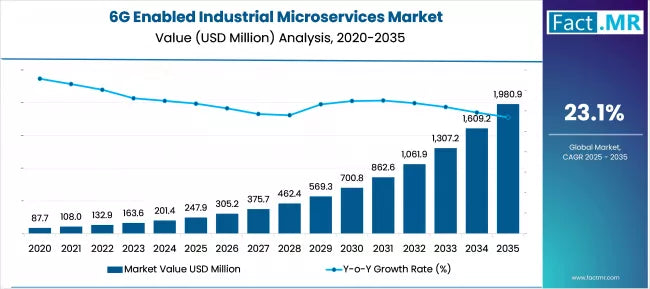

The 6G-enabled industrial microservices market is on a trajectory of remarkable growth, expanding from USD 247.9 million in 2025 to an estimated USD 1,987.4 million by 2035. This represents an absolute increase of USD 1,739.5 million, translating to a total growth of 701.7%. The market is anticipated to achieve this through a compound annual growth rate (CAGR) of 23.1% over the forecast period. Overall, the market size is expected to multiply by more than 8.0 times, fueled by the rapid adoption of 6G infrastructure, surging demand for ultra-low latency applications in industry, and a heightened focus on autonomous manufacturing systems across various sectors.

Quick Market Statistics

Key highlights for the 6G-enabled industrial microservices market include a starting value of USD 247.9 million in 2025, rising to USD 1,987.4 million by 2035 at a CAGR of 23.1%. The platforms and frameworks component leads with a 52.8% share, while key growth regions encompass Asia Pacific, North America, and Europe. Prominent players driving the market are Microsoft Corporation, Amazon Web Services Inc., Google LLC, IBM Corporation, Cisco Systems Inc., Nokia Corporation, Ericsson AB, Intel Corporation, and Huawei Technologies Co. Ltd.

Growth Phases: 2025-2030 and 2030-2035

From 2025 to 2030, the market is set to grow from USD 247.9 million to USD 734.2 million, adding USD 486.3 million in value, which accounts for 28.0% of the total decade-long growth. This initial phase will be influenced by accelerated 6G infrastructure rollout, deeper integration of edge computing in industrial workflows, and rising use of real-time autonomous systems in manufacturing. Tech firms are broadening their 6G microservices offerings to meet the need for high-speed, low-latency connectivity in automation and smart factories.

In the subsequent period from 2030 to 2035, the market will surge from USD 734.2 million to USD 1,987.4 million, contributing an additional USD 1,253.2 million or 72.0% of the overall expansion. This era will feature broad commercial 6G adoption, AI fusion with microservices, and the rise of fully autonomous industrial setups. Demand will be propelled by digital twins and real-time industrial analytics, pushing for more advanced, reliable 6G solutions.

Historical Growth: 2020-2025

Between 2020 and 2025, the market saw explosive growth, spurred by nascent 6G advancements and awareness of the need for ultra-low latency in industrial settings. Businesses began prioritizing next-gen connectivity for real-time automation and digital overhauls. Research and tech progress highlighted 6G microservices as key to unlocking superior industrial efficiency and competitive edges.

Drivers of Market Growth

The market's expansion is primarily driven by escalating demand for ultra-low latency applications and next-gen connectivity that enables real-time autonomous operations. Industrial firms are gravitating toward 6G microservices for instant responsiveness, seamless device connectivity, and robust automation. The proven benefits of 6G in boosting industrial capabilities and efficiency position it as a cornerstone of future infrastructure.

Additionally, the push toward Industry 4.0 and smart manufacturing heightens the need for solutions that support real-time decisions and automation. Preferences for scalable, adaptable microservices that mesh with 6G networks are fostering innovation. AI integration and autonomous deployments further accelerate adoption across manufacturing and beyond.

Segmental Breakdown

The market segments by component (platforms & frameworks, services, infrastructure), deployment (cloud-based, hybrid/edge-cloud), enterprise size (large enterprises, SMEs), application (smart manufacturing & industrial automation, digital twin & simulation, supply chain optimization, quality control & monitoring), industry vertical (manufacturing, energy & utilities, automotive, healthcare & pharmaceuticals, aerospace & defense, others), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Analysis by Component

Platforms and frameworks dominate with a 52.8% share in 2025, serving as the core for 6G microservices deployment. Enterprises value these for service mesh (24.7%), orchestration (18.9%), and API management (9.2%), providing solid foundations for connectivity and integration in industrial contexts. Their scalability and validation bolster confidence in handling 6G demands.

Analysis by Deployment

Cloud-based deployments lead with 58.3% in 2025, offering flexibility and cost savings over on-premises options. Public cloud holds 32.7%, private cloud 25.6%, catering to dynamic resource needs and innovation. As industries shift to cloud-native setups, this segment will remain pivotal for 6G strategies.

Analysis by Enterprise Size

Large enterprises command 67.4% in 2025, leveraging their resources for complex 6G implementations. They drive market leadership through adoption, testing, and vendor partnerships, acting as early adopters in digital transformation and automation.

Analysis by Application

Smart manufacturing and industrial automation top with 42.8%, emphasizing autonomous systems (19.7%), real-time control (14.3%), and predictive maintenance (8.8%). These deliver efficiency and consistency, aligning with the push for fully autonomous factories.

Market Drivers, Restraints, and Trends

Growth is propelled by ultra-low latency needs and autonomous systems adoption, but challenges include 6G's early maturity, integration complexities, and standardization issues. Trends like edge computing enhance real-time processing and reliability, while AI/ML integration boosts automation, analytics, and optimization in industrial microservices.

Country-Specific Market Insights

South Korea leads with a 28.4% CAGR to 2035, thanks to superior telecom infrastructure and government-backed 6G programs. China follows at 26.8%, fueled by industrial upgrades and smart manufacturing. Japan grows at 25.7% with automation focus, Germany at 24.3% via Industry 4.0, and the USA at 23.1% through innovation ecosystems. Singapore and Finland show steady progress at 22.6% and 21.9%, respectively, via smart initiatives and research.

European Market Distribution

In Europe, Germany holds 32.4% in 2025 (rising to 34.7% by 2035) with Industry 4.0 prowess. The UK (18.9% to 17.8%), France (16.7% to 17.2%), Finland (12.3% to 13.9%), Sweden (9.8% to 8.6%), Netherlands (6.2% to 5.4%), and others follow, driven by digitalization and 6G investments.

Japan and South Korea Segmental Details

In Japan, manufacturing applications lead at 48.7%, automotive at 24.8%, energy at 16.9%, with others at 9.6%. South Korea emphasizes smart manufacturing (52.3%), automotive (21.7%), electronics (16.4%), and others (9.6%), reflecting tech leadership.

Competitive Landscape and Key Players

The market features intense rivalry among tech giants, telecom specialists, and software innovators, with investments in 6G R&D, partnerships, and scalable solutions. Microsoft leads at 16.8%, followed by AWS, Google, IBM, Cisco, Nokia, Ericsson, Intel, and Huawei, each offering tailored platforms for industrial needs.